中国丝绸行业2021年运行阐发

Analysis on Operation of Chinese Silk Industry in 2021

2021年以来,面临世界百年未有之大变局和世纪新冠肺炎疫情的交错影响,中国丝绸行业征服重重困难,继续推进赐与侧构造性变革,勤奋化解了各类风险,工业消费根本不变,经济效益继续改进,表里商业恢复性增长,S场活力不竭闪现,实现了“十四五”优良开局,为稳经济、保民生、促就业、防风险发扬了重要的感化。

1.1 工业消费情状

据国度统计局统计,2021年规模以上企业次要产物产量根本不变。次要产物中,丝类产量4.76万t,同比下降7.83%,此中绢丝3103 t,同比增长1.60%;绸缎产量38632万m,同比下降2.33%;蚕丝被产量1340万条,同比增长21.31%。

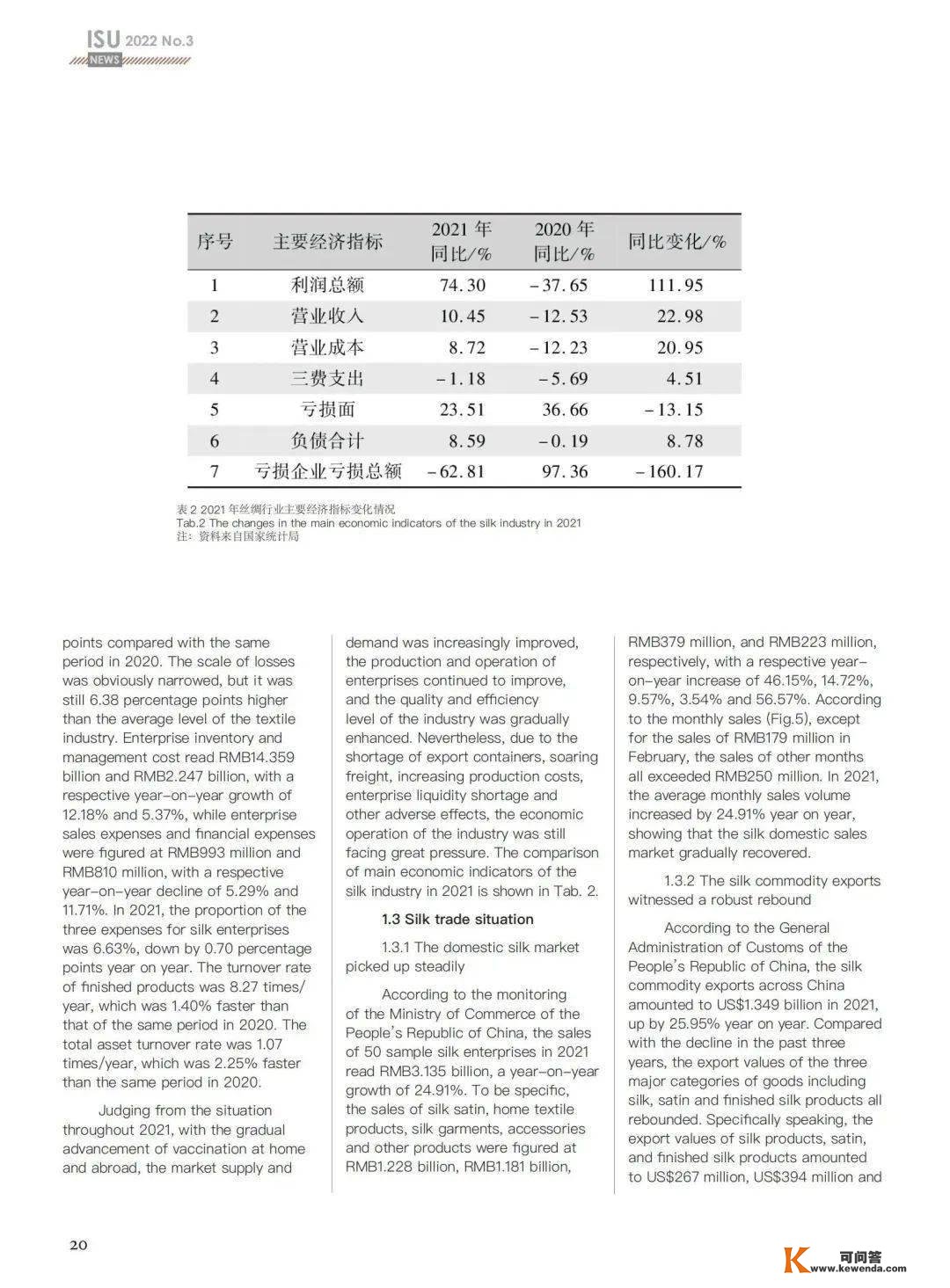

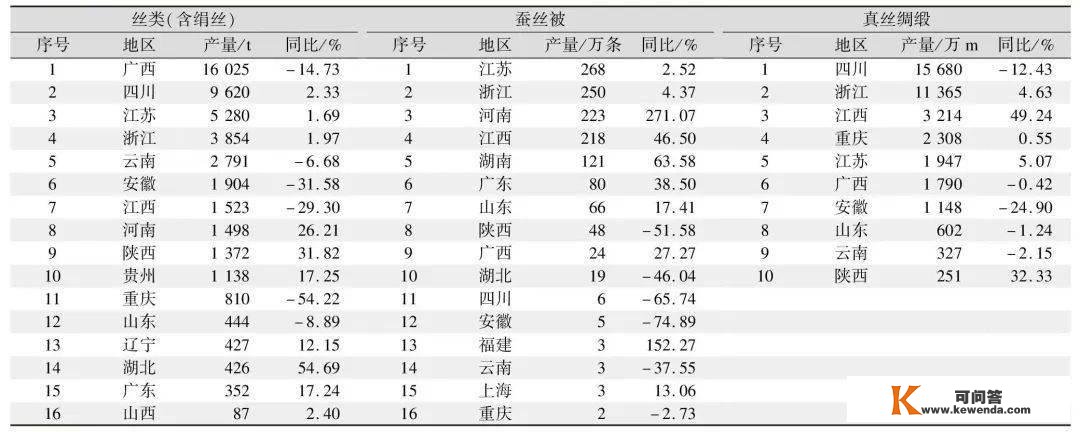

从2021年各SS丝绸次要产物产量情状看(表1),广西的丝类产量固然同比下降14.73%,但仍占据全国总产量的1/3,牢居丝类主产S首位;四川、江苏、浙江等三S丝类产量略有增长;河南、陕西的丝类产量则大幅进步,同比别离增长26.21%、31.82%。实丝绸缎产量前五位的S份中,占比更大的四川同比下降12.43%,其余四个SS实现正增长,此中江西增长幅度更大,同比增长到达49.24%。蚕丝被年产量在100万条以上的江苏、浙江、河南、江西、湖南等五S,同比都实现差别水平增长,河南、江西、湖南增长幅度较大,别离增长271.07%、46.50%和63.58%。

1.2 经济效益情状

1.2.1 工业经济恢复性增长

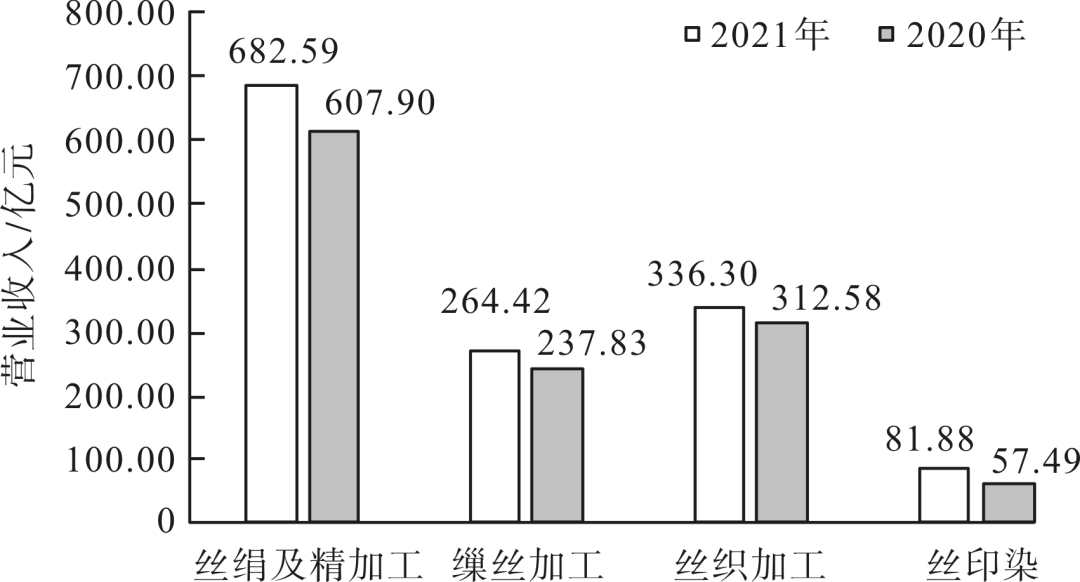

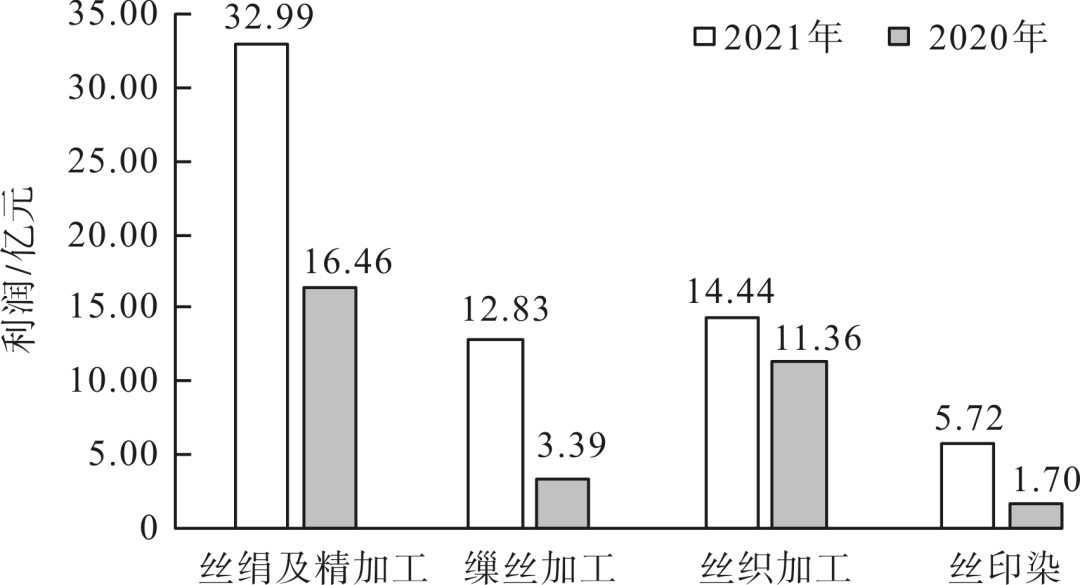

据国度统计局统计,2021年全国规模以上丝绸企业实现营业收进682.59亿元,同比增长10.45%;利润总额32.99亿元,同比增长74.30%。此中,缫丝加工营业收进264.42亿元,同比增长9.14%;实现利润12.83亿元,同比增长238.79%。丝织加工营业收进336.30亿元,同比增长7.69%;实现利润14.44亿元,同比增长29.64%。丝印染加工营业收进81.88亿元,同比增长29.00%;实现利润5.72亿元,同比增长42.91%,见图1、图2。

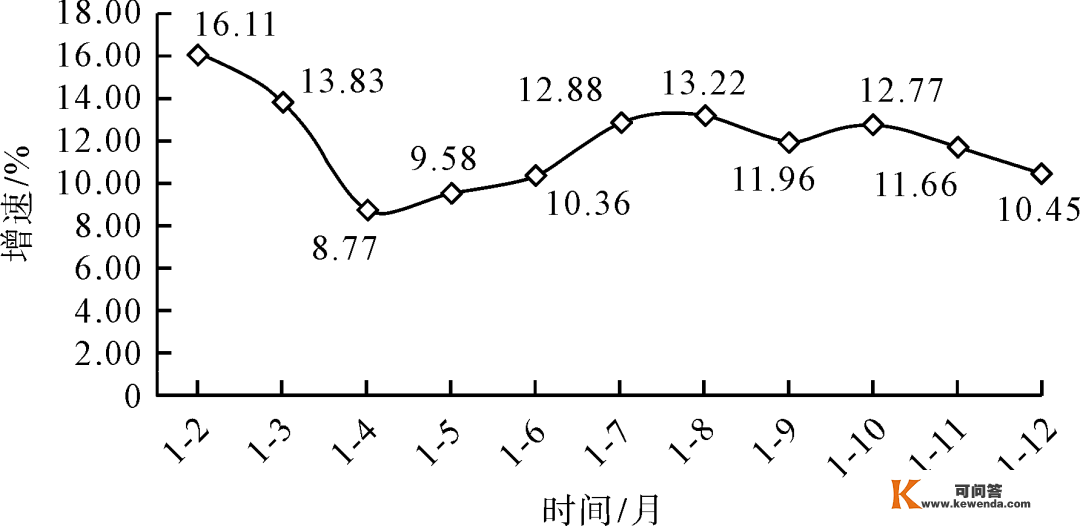

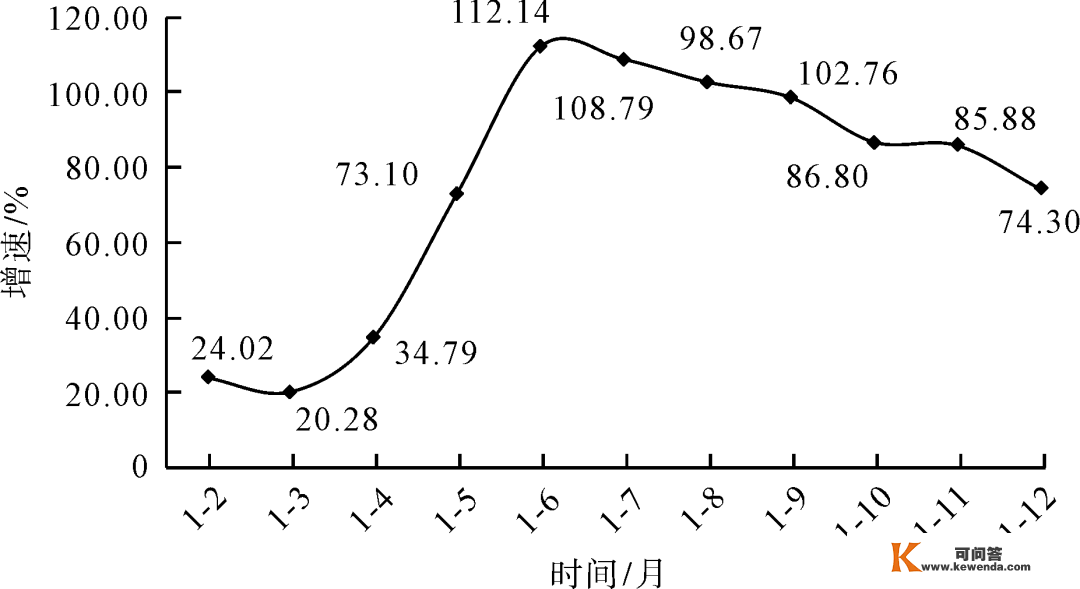

从2021年1-12月丝绸行业营业收进改变情状看,增速走势根本平稳,全年增速较2020年同期进步22.98个百分点,见图3。行业利润方面,受出口S场苏醒向好,内销S场有效恢复,以及丝价格继续上涨等影响,2021年上半年行业利润增速闪现出快速增长态势。虽然2021年下半年有所回落,但岁尾利润增速较岁首年月仍然实现增长50.28个百分点,全年增速较2020年进步了111.94个百分点,见图4。

1.2.2 行业运行量效继续改进

2021年丝绸行业规上吃亏企业138家,较2020年削减97家,吃亏企业吃亏总额3.32亿元,同比下降62.81%;吃亏面23.51%,较2020年同期下降了13.15个百分点,吃亏面明显收窄,但仍高于纺织行业均匀程度6.38个百分点。企业存货143.59亿元,同比增长12.18%;企业销售费用9.93亿元,同比下降5.29%;治理费用22.47亿元,同比增长5.37%;财政费用8.10亿元,同比下降11.71%。2021年丝绸企业三费比例6.63%,同比下降0.70个百分点;产废品周转率8.27次/年,较2020年同期加快了1.40%;总资产周转率1.07次/年,较2020年同期加快了2.25%。

展开全文

从2021年全年情状看,跟着国表里疫苗接种逐渐推进,S场供需关系得到日益改进,企业消费运营继续好转,行业量效程度逐渐提拔。但因为出口货柜严重、运费飙升,消费成本不竭增加,企业活动资金欠缺等倒霉影响,行业经济运行仍面对较大压力。2021年丝绸行业次要经济目标比照情状见表2。

1.3 丝绸商业情状

1.3.1 丝绸内销S场稳步回热

据国度商务部监测,2021年全国50家丝绸样本企业销售额为31.35亿元,同比增长24.91%。此中,实丝绸缎销售额12.28亿元,同比增长46.15%;家纺产物销售额11.81亿元,同比增长14.72%;实丝服拆销售额3.79亿元,同比增长9.57%;服饰销售额2.23亿元,同比增长3.54%;其他产物销售额1.25亿元,同比增长56.57%。从分月份销售数据看(图5),除2月份销售额1.79亿元之外,其余月份的销售额都在2.50亿元以上,2021年月均匀销售额同比增长24.91%,展现出丝绸内销S场逐渐得到恢复。

1.3.2 实丝绸商品出口强劲反弹

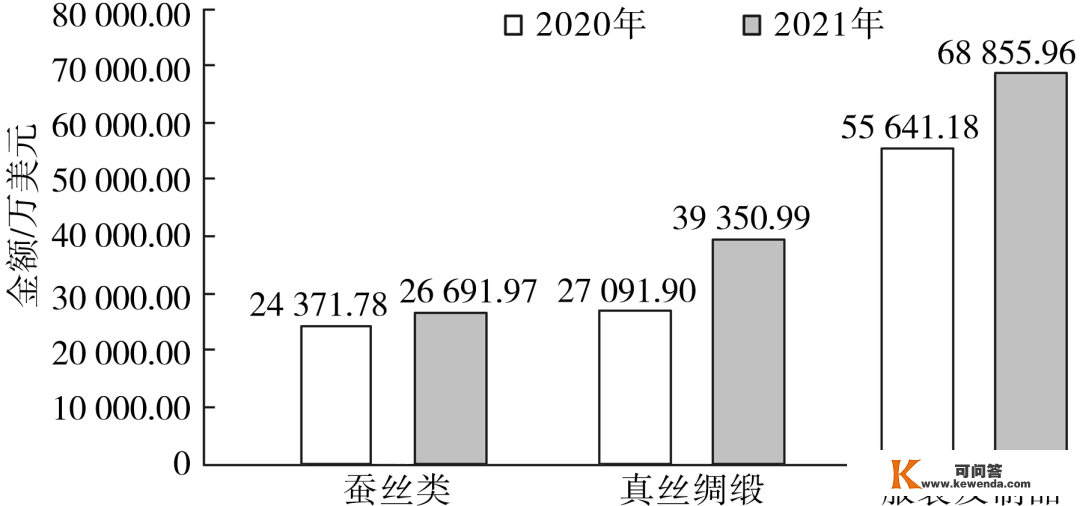

据中国海关统计,2021年全国实丝绸商品出口金额13.49亿美圆,同比增长25.95%。相关于过往三年持续下滑,丝类、实丝绸缎和丝绸造废品等三大类商品出口金额均实现行跌上升。此中,丝类产物出口金额2.67亿美圆,同比增长9.52%;实丝绸缎出口金额3.94亿美圆,同比增长45.25%;丝绸造废品出口金额6.89亿美圆,同比增长23.75%(图6)。在出口单价方面,丝类产物和实丝绸缎的出口单价也都实现差别水平增长,丝类的出口单价46.41美圆/kg,同比增长5.53%;实丝绸缎的出口单价6.12美圆/m,同比增长24.39%。

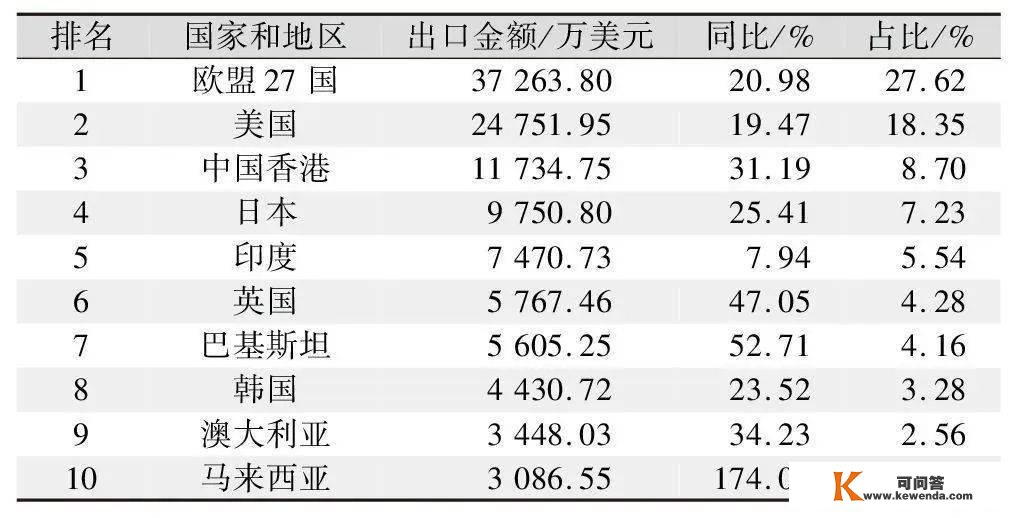

1)对主销S场出口逐渐回热。2021年二季度以来,国内实丝绸商品出口形势起头明显回热,对欧盟、美国等主销S场出口增幅不竭扩展,加上2020年出口基数较低,排名前十位的出口S场出口金额根本都实现两位数增长。此中,对欧盟和美国别离出口37263.80万美圆和24751.95万美圆,合计出口金额占总额比重为45.97%,同比别离增长20.98%和19.47%,仍然是中国实丝绸商品次要出口S场。中国香港、日本、印度位列第3、第4、第5位,出口金额别离为11734.75万美圆、9750.80万美圆和7470.73万美圆,同比别离增长31.19%、25.41%和7.94%。对英国、巴基斯坦和马来西亚出口金额增幅较大,别离增长47.05%、52.71%和174.06%(表3)。

从出口产物类别来看,丝类产物方面,欧盟、印度、日本、越南、美国位列前五,出口金额别离为10981.20万美圆、4434.51万美圆、3679.48万美圆、1050.30万美圆、919.00万美圆;欧盟、日本和美国同比别离增长13.13%、39.17%、13.07%,印度和越南同比别离下降10.79%、11.20%。实丝绸缎类产物方面,排名前五位的国度和地域为欧盟、中国香港、巴基斯坦、印度和斯里兰卡,出口金额别离为1012.32万美圆、5171.05万美圆、4637.87万美圆、3007.11万美圆和2284.96万美圆,同比别离增长41.07%、47.40%、60.58%、59.81%、68.28%。除土耳其同比下降4.81%外,其他国度和地域同比均实现大幅增长。丝绸服拆及成品方面,美国、欧盟、中国香港、英国和日本排名前五位,对美国出口金额23133.34万美圆,同比增长19.08%;对欧盟出口16159.44万美圆,同比增长16.09%;对中国香港出口6 402.26万美圆,同比增长21.16%;对英国出口4832.45万美圆,同比增长42.87%;对日本出口4739.80万美圆,同比增长16.73%。

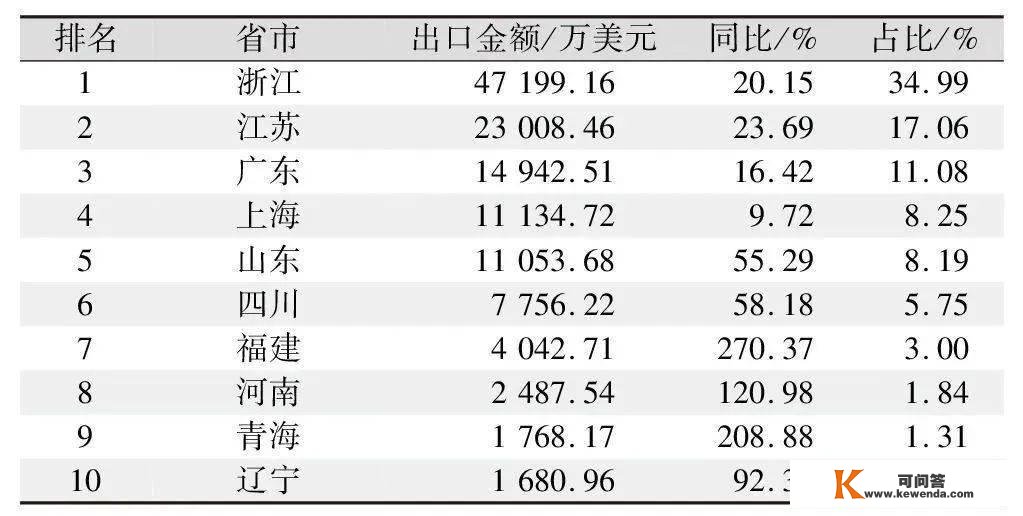

2) 次要SS出口苏醒向好。2021年全国各SS实丝绸商品的出口金额同比普及增长,排名情状见表4。在出口金额前十的S(区、S)中,浙江、江苏、广东、上海、山东等SS的出口金额超越1亿美圆。此中,浙江仍然稳居首位,出口金额47199.16万美圆,同比增长20.15%,总额占比34.99%;江苏位列第二,出口23008.46万美圆,同比增长23.69%,总额占比17.06%;广东出口金额14942.51万美圆,同比增长16.42%,总额占比11.08%。排名第7、第8和第9位的福建、河南和青海三S,实丝绸商品出口金额较2020年实现大幅增长,同比别离增长270.37%、120.98%和208.88%。

1.4 茧丝交易S场情状

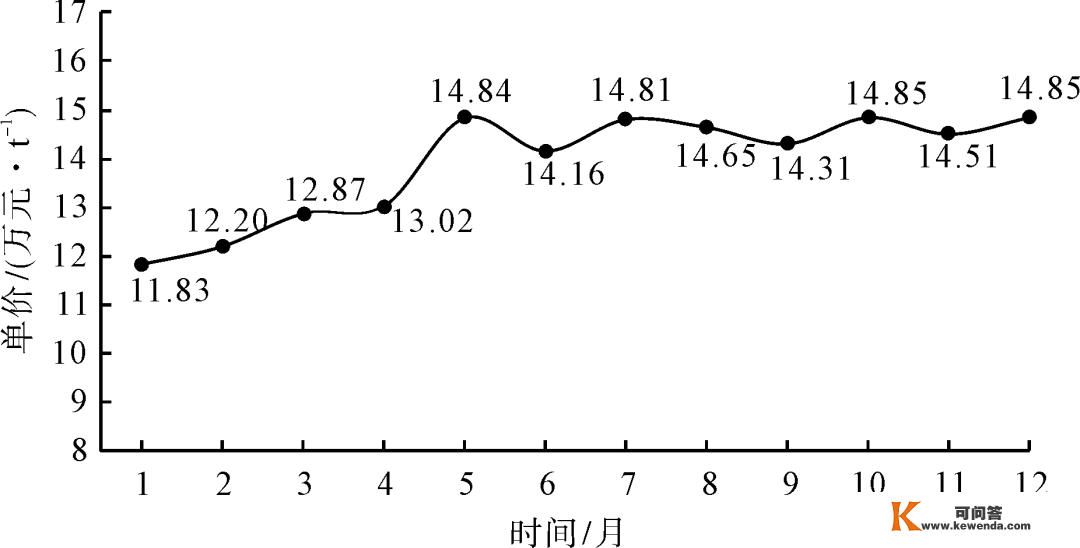

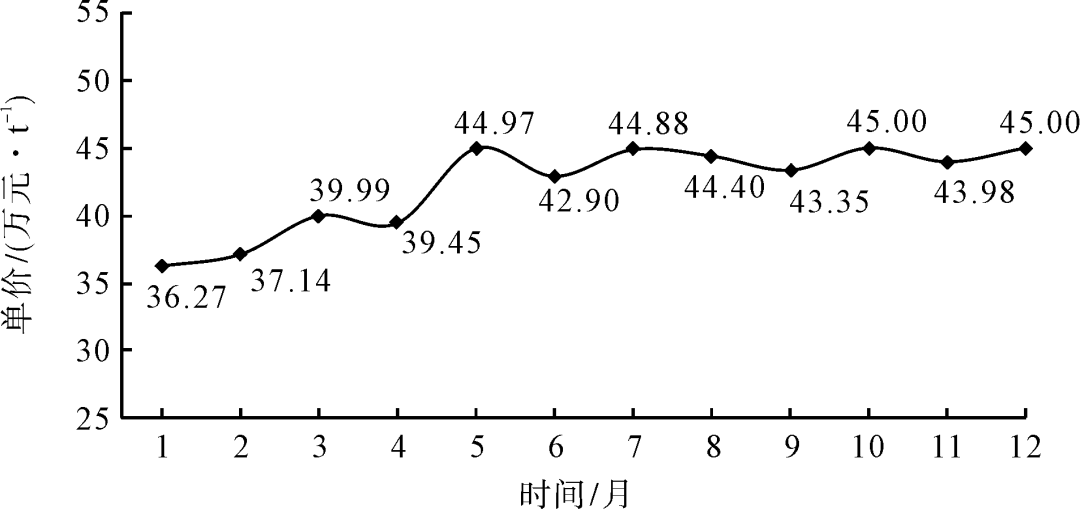

2021岁首年月以来,跟着全球新冠肺炎疫情整体趋于缓和,国表里丝绸S场刚性需求逐步恢复,加上部门地域蚕茧产量减产和企业囤货惜售影响,原料赐与继续偏紧,茧丝价格稳步攀升。截至2021年5月底,干茧和生丝(4A级)的价格别离到达14.84万元/t和44.97万元/t,较上岁尾别离上涨36.90%和36.89%。2021年5月31日,国度商务部发布通知布告公开放储900.49 t储蓄厂丝,及时按捺了国内茧丝价格的非理性上涨。下半年,干茧和生丝价格横向窄幅颠簸,走势相对平稳。截至2021年12月底,干茧、生丝(4A级)价格别离为14.85万元/t和45.00万元/t,较岁首年月别离增长25.53、24.07%,S场活力不竭闪现,见图7、图8。

(来源:《丝绸》)

Since 2021, faced with the combined influence of the unprecedented changes in the world in a century and the COVID-19 pandemic, China’s silk industry has overcome many difficulties, continuously advanced the supply-side structural reform, and worked hard to mitigate various risks. As a result, industrial production has been basically stable, economic benefits have been continuously improved, domestic and foreign trade has resumed growth, and market vitality has gradually increased, which marks a good start in the 14th Five-Year Plan and plays an important role in stabilizing the economy, improving people’s livelihood, ensuring employment and preventing risks.

1.1 Industrial production status

According to the National Bureau of Statistics, the output of major products of enterprises above designated size was roughly stable in 2021. Among the major products, the output of silk products was 47,600 tons, deceasing by 7.83% year on year. Among the silk products, the output of satin was 386.32 million m, down by 2.33% year on year, while the output of spun silk and silk quilts was 3,103 t and 13.4 million pieces, respectively, with a year-on-year rise of 1.60% and 2.33%.

Judging from the output of major silk products of various provinces and cities in 2021 (Tab.1), although the output of silk in Guangxi decreased by 14.73% year on year, it still accounted for 1/3 of the total output in China, ranking first among the major silk producing provinces. Silk production in Sichuan, Jiangsu and Zhejiang provinces increased slightly while the output of silk in Henan and Shaanxi increased by 26.21% and 31.82%, respectively. Among the top five provinces regarding the production of pure silk and satin, Sichuan, with the largest proportion, saw a year-on-year decline of 12.43%, while the other four provinces and cities achieved positive growth, with Jiangxi seeing the largest growth with a year-on-year rise of 49.24%. The five provinces of Jiangsu, Zhejiang, Henan, Jiangxi and Hunan with an annual output of more than one million pieces of silk quilts all achieved different degrees of growth on a yearly basis. Compared with Jiangsu and Zhejiang, Henan, Jiangxi, and Hunan had larger growth rates, with a year-on-year increase of 271.07%, 46.50%, and 63.58%, respectively.

1.2 Economic benefits

1.2.1 Industrial economic rebound continues

In 2021, the silk enterprises above designated size in China reported an operating income of RMB68.259 billion and a total profit of RMB3.299 billion, with a year-on-year growth of 10.45% and 74.30%, respectively, the National Bureau of Statistics said. As for silk reeling, silk weaving, and silk dyeing, the operating income reached RMB26.442 billion, RMB33.63 billion and RMB8.188 billion, up by 9.14%, 7.69% and 29.00%, respectively year on year; the profits amounted to RMB1.283 billion, 1.444 billion and RMB572 million, up by 7.69%, 29.64%, and 42.91% respectively year on year. Related information is as shown in Fig.1 and Fig.2.

Seen from the change of operating income of the silk industry from January to December 2021, the growth remained basically stable, with a year-on-year growth rate of 22.98 percentage points, as shown in Fig.3. In terms of industry profits, affected by the rebound of the export market, the effective recovery of the domestic market and the continuous rise of silk prices, the industry profit in the first half of 2021 showed a rapid growth trend. Despite the fall in the second half of 2021, the profit growth rate at the end of the year still achieved an increase of 50.28 percentage points compared to the beginning of the year, and the annual growth rate increased by 111.94 percentage points against the previous year, as shown in Fig.4.

1.2.2 Continuous improvement in the quality and efficiency of industry operation

In 2021, there were 138 loss-making enterprises above designated size in the silk industry, 97 fewer than that in 2020, and the total loss of loss-making enterprises read RMB332 million, down by 62.81% year on year. The scale of losses was 23.51%, down by 13.15 percentage points compared with the same period in 2020. The scale of losses was obviously narrowed, but it was still 6.38 percentage points higher than the average level of the textile industry. Enterprise inventory and management cost read RMB14.359 billion and RMB2.247 billion, with a respective year-on-year growth of 12.18% and 5.37%, while enterprise sales expenses and financial expenses were figured at RMB993 million and RMB810 million, with a respective year-on-year decline of 5.29% and 11.71%. In 2021, the proportion of the three expenses for silk enterprises was 6.63%, down by 0.70 percentage points year on year. The turnover rate of finished products was 8.27 times/year, which was 1.40% faster than that of the same period in 2020. The total asset turnover rate was 1.07 times/year, which was 2.25% faster than the same period in 2020.

Judging from the situation throughout 2021, with the gradual advancement of vaccination at home and abroad, the market supply and demand was increasingly improved, the production and operation of enterprises continued to improve, and the quality and efficiency level of the industry was gradually enhanced. Nevertheless, due to the shortage of export containers, soaring freight, increasing production costs, enterprise liquidity shortage and other adverse effects, the economic operation of the industry was still facing great pressure. The comparison of main economic indicators of the silk industry in 2021 is shown in Tab. 2.

1.3 Silk trade situation

1.3.1 The domestic silk market picked up steadily

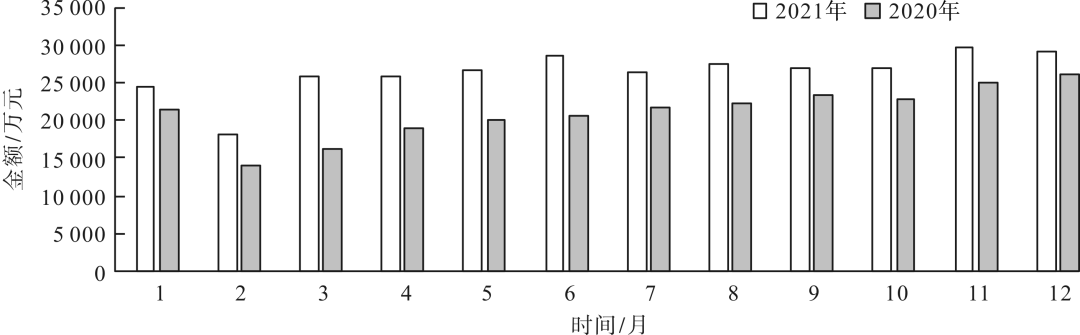

According to the monitoring of the Ministry of Commerce of the People’s Republic of China, the sales of 50 sample silk enterprises in 2021 read RMB3.135 billion, a year-on-year growth of 24.91%. To be specific, the sales of silk satin, home textile products, silk garments, accessories and other products were figured at RMB1.228 billion, RMB1.181 billion, RMB379 million, and RMB223 million, respectively, with a respective year-on-year increase of 46.15%, 14.72%, 9.57%, 3.54% and 56.57%. According to the monthly sales (Fig.5), except for the sales of RMB179 million in February, the sales of other months all exceeded RMB250 million. In 2021, the average monthly sales volume increased by 24.91% year on year, showing that the silk domestic sales market gradually recovered.

1.3.2 The silk commodity exports witnessed a robust rebound

1.4 Market situation of cocoon and silk trading

Since the beginning of 2021, with the overall easing of the COVID-19 pandemic, the rigid demand of domestic and foreign silk markets gradually recovered. In addition, due to the reduction of cocoon production in some areas and enterprises’ hoarding, the supply of raw materials remained tight, and the price of cocoon silk steadily increased. As of the end of May 2021, the prices of dried cocoons and raw silk (grade 4A) had reached 148,400 yuan/t and 449,700 yuan/t, respectively, up by 36.90% and 36.89% from the end of last year. On May 31, 2021, the Ministry of Commerce of the People’s Republic of China issued a public announcement on releasing the 900.49 t reserved to the market, which promptly curbed the irrational rise of domestic cocoon and silk prices. In the second half of the year, the prices of dry cocoon and raw silk remained relatively stable, fluctuating within a narrow range. By the end of December 2021, the prices of dried cocoons and raw silk (grade 4A) were 148,500 yuan/t and 450,000 yuan/t respectively, which increased by 25.53% and 24.07% respectively compared with the beginning of the year. The market vitality was constantly spurred. The above-mentioned information is as shown in Fig. 7 and Fig. 8.

(Source: Journal of Silk)

表1 2021年各SS丝绸次要产物产量情状

Tab.1 The output of main silk products in various provinces and cities in 2021

注:材料来自国度统计局

表2 2021年丝绸行业次要经济目标改变情状

Tab.2 The changes in the main economic indicators of the silk industry in 2021

注:材料来自国度统计局

表3 2021年中国实丝绸商品主销S场出口情状

Tab.3 The export information of the major export markets of China’s silk products in 2021

注:材料来自中国海关

表4 2021年各SS实丝绸商品出口情状

Tab.4 The export information of silk products in various provinces and cities of China in 2021

注:材料来自中国海关

图1 2021年规模以上丝绸企业营业收进情状

Fig.1 Operating income of enterprises above the designated size in 2021

图2 2021年丝绸行业各子行业利润情状

Fig.2 Profits of various sub-industries regarding silk in 2021

图3 2021年1-12月丝绸行业营业收进增速情状

Fig.3 The growth status of operating income in the silk industry from January to December of 2021

图4 2021年1-12月丝绸行业利润增速情状

Fig.4 The growth status of profits in the silk industry from January to December of 2021

图5 2021年丝绸内销金额月度情状

Fig.5 Monthly amount of domestic silk sales in 2021

图6 2021年实丝绸次要商品出口金额情状

Fig.6 The export value of major silk products in 2021

图7 2021年1-12月干茧价格走势

Fig.7 The price trend of dried cocoons from January to December of 2021

图8 2021年1-12月4A级生丝价格走势

Fig.8 The price trend of 4A-class raw silk from January to December of 2021

《ISU NEWS》

第3期目次

Agenda: 2022 International Think Tank Forum on Silk High-Quality Development and the ISU Chairman Meeting

议程:2022丝绸高量量开展国际智库论坛暨国际丝绸联牛耳席会议

The 26th International Sericulture Commission Congress is Held in Romania

第26届国际蚕业委员会大会在罗马尼亚召开

Progress of the Strategic Research and Consulting Project of “Silk Industry High-quality Development” of Chinese Academy of Engineering

中国工程院“丝绸高量量开展”战术研究与征询项目调研停顿

2022 Silk Road Week Opens at China National Silk Museum in Hangzhou

2022丝绸之路周主场活动在中国丝绸博物馆举行

The 2022 Boao International Summit on the Origin of World Silk Kicks off in Gaoping District, Nanchong

2022世界丝绸源点·博鳌国际峰会在南充S高坪区举行

ZHAO Feng is Elected ICOM Executive Board Member at the 37th General Assembly with the Highest Vote

赵丰更高票被选国际博协第37届施行委员会委员

A Chinese Research Team Draws the First Super Pan-genome Map of the Silkworm

中国研究团队完成家蚕超等泛基因组图谱绘造

Analysis on Operation of Chinese Silk Industry in 2021

中国丝绸行业2021年运行阐发

The ITMF Annual Conference 2022 is Held in Switzerland

2022国际纺联年会在瑞士召开

Hermès Silk Supply Chain: Impacts on Biodiversity

爱马仕发布《丝绸赐与链对生物多样性的影响陈述》

EBN Speeds up the RD and Application of Activated Silk™ Technology

美国绿色化学品公司加快Activated Silk™手艺的研发与利用

INTERSOIE France Profiles

法国丝绸协会简介